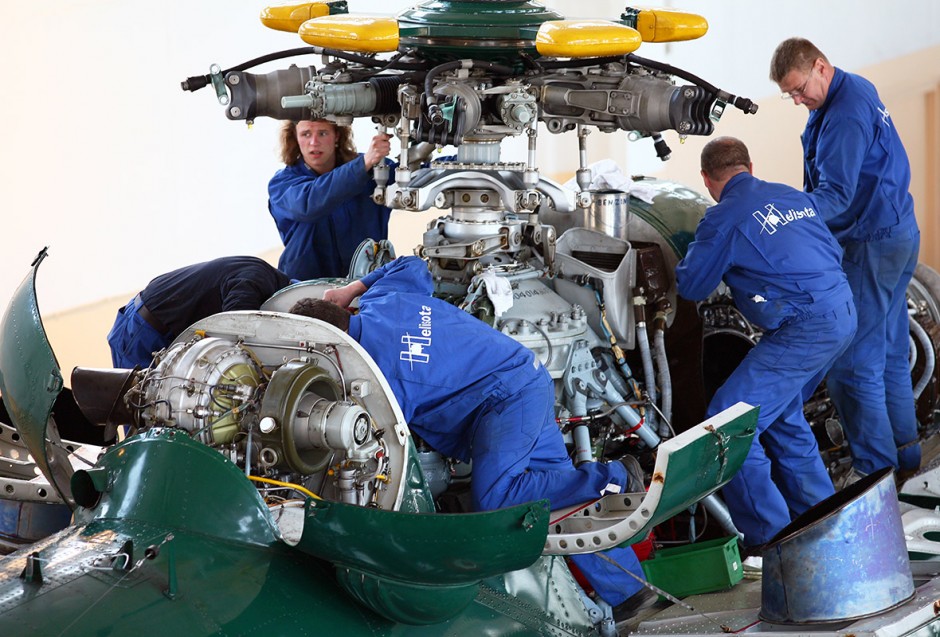

The helicopter MRO service industry has undergone significant changes and advancements in recent years. As of 2024, the global helicopter MRO market is estimated to be valued at over $10.23 billion, with a projected compound annual growth rate (CAGR) of around 4.57% from 2023 to 2028.

One of the key drivers of this growth is the increasing demand for helicopter services across various sectors, including military, emergency medical services (EMS), law enforcement, and commercial transportation. The rising demand for helicopter operations, coupled with the need for regular maintenance and repairs, has fueled the growth of the MRO market.

Informational Source:

https://www.fortunebusinessinsights.com/helicopter-mro-services-market-104078

Companies Covered in helicopter MRO service industry are:

- Airbus SAS (The Netherlands)

- Heli-One (Canada)

- Honeywell International Inc. (The U.S.)

- Leonardo S.p.A (Italy)

- MTU Aero Engines AG (Germany)

- Rolls-Royce Plc (The U.K)

- Safran Group (France)

- StandardAero (The U.S.)

- Textron Inc. (The U.S.)

- Raytheon Technologies Corporation (The U.S.)

Technological Advancements in Helicopter MRO

The helicopter MRO industry has witnessed a surge in technological innovations that have transformed the way maintenance and repair services are performed. Here are some of the latest advancements:

-

Predictive Maintenance: Helicopter operators are increasingly adopting predictive maintenance solutions that leverage data analytics and machine learning to forecast potential failures and schedule maintenance proactively. This approach helps to reduce unplanned downtime, optimize maintenance schedules, and improve overall fleet availability.

-

Augmented and Virtual Reality (AR/VR): MRO service providers are integrating AR and VR technologies into their operations to enhance maintenance and repair processes. Technicians can use AR-enabled smart glasses or tablets to access real-time data, technical manuals, and step-by-step instructions, improving efficiency and reducing the risk of errors.

-

Additive Manufacturing (3D Printing): The use of 3D printing in helicopter MRO has gained traction, allowing for the on-demand production of spare parts and components. This technology reduces lead times, inventory costs, and the need for traditional manufacturing processes, particularly for hard-to-find or obsolete parts.

-

Condition-Based Monitoring: Advanced sensor technologies and the Internet of Things (IoT) are enabling comprehensive condition-based monitoring of helicopter systems and components. This approach helps to identify potential issues early, enabling proactive maintenance and reducing the risk of unexpected failures.

-

Automated Inspection and Diagnostics: Helicopter MRO facilities are leveraging robotic systems and artificial intelligence to automate various inspection and diagnostic tasks, such as ultrasonic testing, borescope inspections, and structural integrity assessments. This helps to improve the accuracy, consistency, and speed of these critical maintenance activities.

Trends in Helicopter MRO Services

The helicopter MRO industry is also witnessing several key trends that are shaping the landscape:

-

Increased Focus on Sustainability and Environmental Responsibility: Helicopter operators and MRO providers are placing greater emphasis on sustainability and environmental stewardship. This includes the use of eco-friendly materials, the implementation of energy-efficient maintenance practices, and the adoption of sustainable waste management strategies.

-

Expansion of Helicopter MRO Hubs: Major helicopter manufacturers and independent MRO providers are establishing strategic maintenance hubs in key geographical locations to serve a broader customer base. These hubs offer comprehensive MRO services, including scheduled maintenance, repairs, and overhauls, as well as specialized capabilities such as modifications and upgrades.

-

Collaborative Partnerships and Outsourcing: Helicopter operators are increasingly engaging in collaborative partnerships with MRO service providers, leveraging their expertise and capabilities to optimize maintenance costs and improve operational efficiency. Additionally, the trend of outsourcing non-core MRO activities to specialized service providers continues to gain traction.

-

Workforce Development and Training: With the growing complexity of helicopter systems and the demand for skilled technicians, MRO providers are investing heavily in workforce development and training programs. This includes the use of advanced simulation-based training, online learning platforms, and knowledge-sharing initiatives to ensure a highly skilled and adaptable workforce.

-

Integration of Blockchain Technology: Some helicopter MRO providers are exploring the use of blockchain technology to enhance supply chain transparency, improve traceability of parts and components, and streamline maintenance documentation processes. This emerging technology has the potential to increase trust, security, and efficiency in the MRO ecosystem.

Regional Trends in Helicopter MRO

While the global helicopter MRO market exhibits several overarching trends, there are also notable regional variations:

North America: The North American region, particularly the United States, remains a dominant player in the helicopter MRO market. This is driven by the strong presence of major helicopter manufacturers, a robust military and commercial aviation sector, and a well-established network of MRO service providers. The region is also leading the adoption of advanced technologies, such as predictive maintenance and automated inspection, to improve the efficiency and reliability of helicopter operations.

Europe: The European helicopter MRO market is characterized by a mix of established OEM-affiliated service centers and independent MRO providers. The region has a strong focus on regulatory compliance, environmental sustainability, and the integration of new technologies. European MRO providers are actively investing in facility upgrades, workforce development, and the expansion of their service capabilities to cater to the diverse needs of the region’s helicopter operators.

Asia-Pacific: The Asia-Pacific region is experiencing rapid growth in the helicopter MRO market, driven by the rising demand for helicopter services in sectors like emergency medical services, law enforcement, and offshore operations. Key markets like China, India, and Japan are witnessing significant investments in infrastructure development, the establishment of new MRO facilities, and the localization of maintenance and repair capabilities to serve the growing regional fleet.

Latin America: The Latin American helicopter MRO market is relatively smaller compared to other regions, but it is poised for expansion due to the increasing demand for helicopter services in the oil and gas, mining, and emergency response sectors. MRO providers in the region are focused on improving their service offerings, expanding their geographical reach, and collaborating with local and international partners to cater to the unique needs of the region’s helicopter operators.

Middle East and Africa: The Middle East and Africa region is experiencing a mixed growth pattern in the helicopter MRO market. While countries like the United Arab Emirates and Saudi Arabia have well-established MRO hubs and are actively investing in new capabilities, other parts of the region face challenges related to infrastructure, regulatory frameworks, and access to skilled labor. MRO providers in this region are focusing on developing tailored solutions to address the specific requirements of the local helicopter operators.

Competitive Landscape and Key Players

The helicopter MRO market is highly competitive, with a mix of original equipment manufacturers (OEMs), independent MRO service providers, and regional players. Some of the key players in the global helicopter MRO market include:

-

Airbus Helicopters: The helicopter division of Airbus offers a comprehensive range of MRO services, including scheduled maintenance, repairs, and overhauls, for its entire helicopter fleet. The company has a global network of authorized service centers and is known for its focus on technological innovation and customer support.

-

Bell Textron: As a leading helicopter manufacturer, Bell Textron provides a wide array of MRO services for its helicopters, leveraging its in-depth understanding of the aircraft’s design and specifications. The company’s MRO offerings include scheduled maintenance, inspections, upgrades, and customization services.

-

Leonardo Helicopters: The helicopter division of Leonardo, an Italian aerospace and defense company, offers a broad spectrum of MRO services for its helicopter fleet. The company has a global network of service centers and is known for its expertise in customized maintenance and modification solutions.

-

Safran Helicopter Engines: As a leading manufacturer of helicopter engines, Safran Helicopter Engines provides comprehensive MRO services for its engine models, including overhauls, repairs, and technical support. The company’s global network of maintenance facilities and its focus on innovation and customer service make it a key player in the helicopter MRO market.

-

StandardAero: StandardAero is a leading independent MRO service provider, offering a wide range of maintenance, repair, and overhaul services for various helicopter models from major manufacturers. The company’s extensive expertise, global footprint, and focus on providing customized solutions have made it a trusted partner for helicopter operators worldwide.

-

Honeywell Aerospace: Honeywell Aerospace, a diversified technology and manufacturing company, provides MRO services for a variety of helicopter components and systems, including avionics, engines, and mechanical systems. The company’s strong technical capabilities and global support network make it a valuable partner for helicopter operators.

-

Heli-One: Heli-One is a leading independent helicopter MRO provider, offering a comprehensive suite of maintenance, repair, and overhaul services for a wide range of helicopter models. The company’s specialized capabilities, including major inspections, component overhauls, and modifications, have made it a preferred choice for many helicopter operators.

These key players, along with a growing number of regional and specialized MRO providers, are shaping the competitive landscape of the global helicopter MRO market, driving innovation, improving service quality, and meeting the evolving needs of helicopter operators worldwide.